How the Global Crypto Boom Will Benefit the Real Estate Market

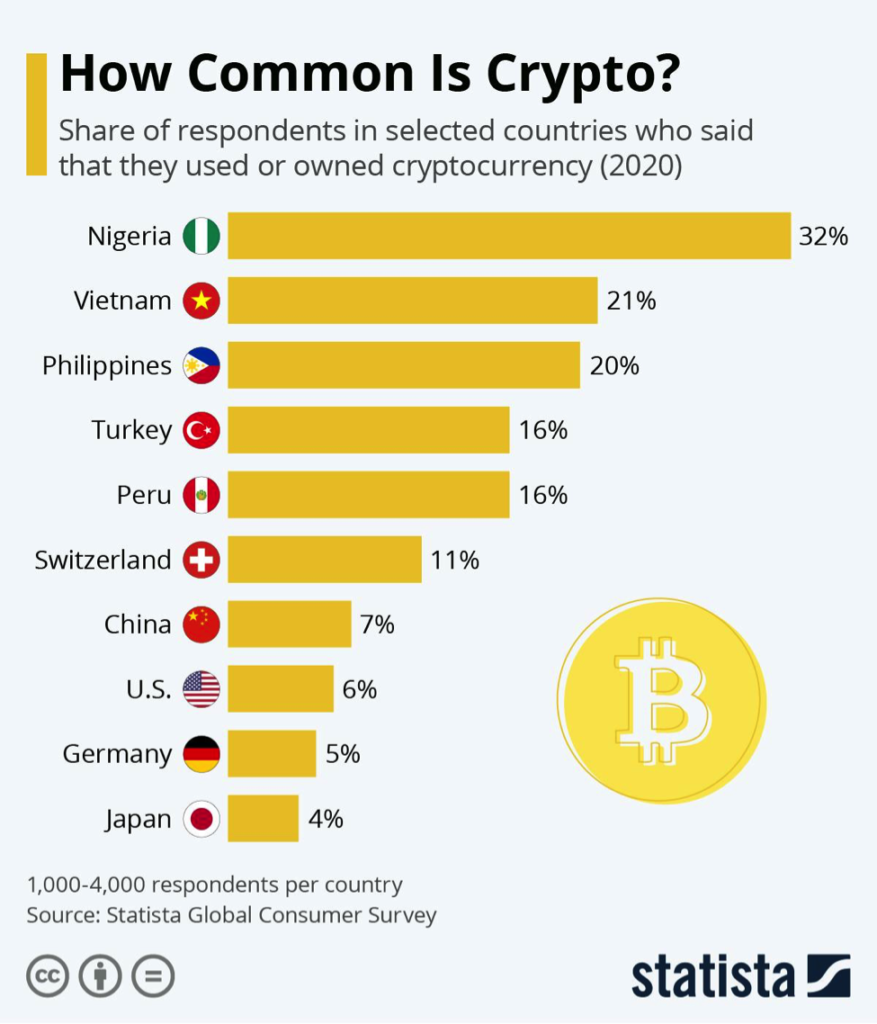

Gone are the days where cryptocurrencies were a gamble for day traders. The rise of the digital age is quickly making crypto a global currency. More and more people in countries across the globe are not only buying crypto, but they are also using it to make significant purchases—including real estate.

What is the reason for the global crypto boom? Exchange rates and the high cost of sending money overseas have led many people to turn to crypto to speed up and simplify all types of transactions across borders.

So, what does this mean for the New York City real estate market? It means that global doors are opening, and it’s time to learn a lot more about crypto currency’s place in New York City residential real estate and New York City commercial real estate.

Why the Global Crypto Real Estate Market is Opening Up

In October of 2020, PayPal launched a new service that makes it possible for account holders to buy, sell, or hold cryptocurrency from 26 million different merchants.

A broad range of buyers and sellers in crypto markets means ample opportunities for New York City real estate brokers and investors. Since New York City has always been a goto place for foreign nationals to invest in real estate, it’s time to embrace the crypto revolution.

One of the most significant benefits of using crypto to buy real estate across borders is that it does away with a central bank. Instead, it uses blockchain encryption to secure funds. As a result, there is no need for a third party on the deal’s financial side. Buyers and sellers can transfer funds on their own.

Another enticing factor about crypto to international real estate investors is time. Where most global real estate transactions can get messy because of fees, a transaction using crypto takes about a day.

What if Only One Person Uses Crypto?

Since cryptocurrency is a digital currency, there is no need to deal with exchange rates for international transactions. So, it’s in the buyer’s and seller’s best interest to use crypto if possible.

Even though the number of crypto users is on the rise, that doesn’t mean everyone is comfortable with it yet. So, if one person involved in the transactions is not a fan of using crypto, global services such as Bitpay, can complete the transaction.

Bitcoin Real Estate Websites Have Unlocked Global Doors

On a fundamental level, websites such as Bithome.com and Bitcoinrealestate.com have made the availability of New York City commercial real estate and New York City residential real estate known to global crypto buyers.

Buying and selling real estate with crypto may be frightening to some; however, these websites act as consulting companies that work to simplify the legal and security facets of using crypto across the globe. When there is a global website that can streamline the progression, it drastically opens up the market.

Crypto and Real Estate Diversity Portfolios

Until recently, crypto has been difficult to spend in bulk. Now PayPal, Visa, and Square are making it easier to transfer funds and pay with crypto. As a result, investors are starting to rebalance their investments into different classes. One of these classes is real estate because it’s a great way to turn crypto into a tangible asset.

Ben Shoul at Magnum Real Estate group validates the benefit of diversifying a portfolio with real estate purchased with crypto. Following the sale of a $15.3 million condominium to a Taiwanese

investor, Shoul explained:

Accepting cryptocurrency for select condominiums in our New York City portfolio enabled us to expand our buyer pool. … For the transactions we did, the U.S. dollar payment was net to us and we locked buyers into prices on day 1. Nothing changes for us as the price of the crypto fluctuates. In multiple cases, the buyers preferred to use it for personal reasons.’ The challenges were how to handle this type of payment on the backend with the offering plans, attorney general, and ensuring all parties were comfortable.

Shoul and Magnum are just one of many New York City real estate agencies that have opened up to the global crypto market.

Creates the Possibility of “Tokenization” Among Global Investors

Tokenization is a relatively new trend in real estate. It allows investors to join blockchain technology with real estate to raise capital more efficiently. As a result, investors can gain access to private real estate investments, transparency, and liquid assets across borders.

While it may seem complicated, tokenization divides shares of real estate and trades them on crypto exchanges or Alternative Trading Systems (ATS), which are accessible globally. The shares are known as “real estate tokens” or “security tokens.”

Here’s how it works. A property owner wishes to sell an estate, so he creates tokens representing shares that add up to the property’s value. Then he sells the tokens to investors in what is known as a security tokens offering.

The biggest benefit to tokenization across the globe is that there is no right way to do it. Some people market their tokens through crowdfunding, while others broker their tokens themselves.

Managing Global Investments Purchased with Crypto

Many people ask how record keeping and management work on tokenized properties. Like any property owned by a team of investors, property management companies are retained to keep track of the real estate’s general operations and bookkeeping.

Firms are brought on board to oversee these global portfolios. Then, blockchain technology allows for sharing data, streamlined rental collections along with payments to property owners. In short, it offers due diligence across investors’ portfolios, all the while increasing efficiency and saving time and money.

An additional benefit is it generates valuable data to foster better decision-making.

Conclusion

The only constant in the world is change, and that is what’s happening across the globe—mostly right in here the New York City residential and New York City commercial real estate markets.

Crypto—despite its risk and known instability—is here to stay. Global investors are finding ways to capitalize on the benefits crypto brings to the international real estate market. It opens up doors for diversification, and it speeds up closing real estate deals.

Without a doubt, the advice, knowledge, and know-how of real estate professionals are vital to all types of New York City real estate buyers. But you can count on the processing of securities, liability management, document processing, and accounting to change due to the global crypto boom.