Overall State Of The Real Estate Market In New York City

With the world jointly suffering from the COVID-19 pandemic, everyone is scrambling to figure out the impacts that this crisis has on the global markets and our day-to-day lives. The virus has taken a particularly substantial toll on NYC real estate. This means the real estate market in New York City is rapidly changing.

The real estate market consists of many different niches. The state of the market overall is a culmination of how all of these different facets function. Take a look at the current state of the New York City real estate market through these different lenses.

Tenants Are Catching Up On Rent, For Now

The first five days in April were a stressful period for New York City landlords. The National Multifamily Housing Committee reported that only 69% of tenants paid some portion of their rent. Compared to previous periods, this was a clear downturn.

In the second week of April, however, things started to look up for New York City real estate. The report, which measured data from 11.5 million apartment units across the nation, found a 15% jump in rent payments. While the numbers are still 7% short of last month and 6% down from this time period last month, it is a notable improvement that is allowing landlords to breathe easier and keep those famous New York attitudes under control.

Outlook

It seems that the initial shock and panic of the coronavirus pandemic has started to subside, which is resulting in an increased flow of rent payments and a positive outlook for New York City residential real estate. Also contributing to the increase is that landlords and their tenants are getting more comfortable with online payment solutions.

That said, New York is the hardest-hit area in the country, which means landlords in the city are feeling the pressures of fewer rent payments more than other states. As May approaches, landlords should prepare for another large downturn, especially as unemployment continues to spike.

Hotel Industry’s Nightmare Starts To Stabilize

Outlook

There is some good news for hotel businesses. There was only a 1% difference between this week and last, which possibly means the New York City real estate industry is beginning to stabilize. Hotels may have finally found the bottom of the barrel and, as troubling as that is, it also signals that the road to recovery is just around the corner.

New York has actually seen an increase in occupancy rate, from 18.3% to 24.8% and revenue per available room is only down 77%. “Only!?” you’re likely saying. Well, compared to Chicago (90% decrease in revenue per room), Los Angeles (85%) and many other cities, New York City is comparatively in an O.K. place.

Unemployment Numbers Cause More Homeowners To Seek Mortgage Relief

Tenants aren’t the only ones struggling to make payments. The financial burdens of the COVID-19 pandemic are also being felt by homeowners. Based on a survey conducted by the Mortgage Bankers Associations, there is an increasing number of borrowers stopping payments on their mortgages; almost 4% of individuals have stopped making these crucial payments. Additionally, loans in forbearance also climbed by 1% in just a single week period.

This is a direct result of the rising unemployment rates affecting the nation. Recently, 17 million Americans applied for unemployment benefits in just a 3-week period. Without a steady source of income, many borrowers are unable to keep up with their payments during the economic shutdown.

Outlook

Unfortunately, the rates on stopped payments and home loans in forbearance are likely going to continue to climb in response to growing unemployment rates and businesses folding under the immense strain of the economic pause.

To alleviate the pressures of mortgage payments, the government is requesting that federally backed loan lenders offer up to 6 months of forbearance advancements without penalty to borrowers. This may not be enough to stymie the fall of payments if the coronavirus continues to keep businesses at a standstill.

Commercial Building Owners Need To Work With Business Tenants

Commercial tenants with nonessential businesses are closing doors in droves. Not only is this affecting unemployment rates, but it is also drawing grave concern from the New York City commercial real estate owners that control these properties. Tenants that close their doors can no longer pay rent, which will cause building owners to struggle with their mortgage payments.

Suggestions for Commercial Landlords

To try and stop the fall of these real estate dominoes, landlords should find ways to work with the businesses in their buildings and find solutions that keep their doors open.Look at the types of businesses in your commercial spaces and identify the ones that will need the most immediate help.

- Look at the types of businesses in your commercial spaces and identify the ones that will need the most immediate help.

- Collaborate with business owners about what services or revenue-generating operations they can still perform in the lockdown.

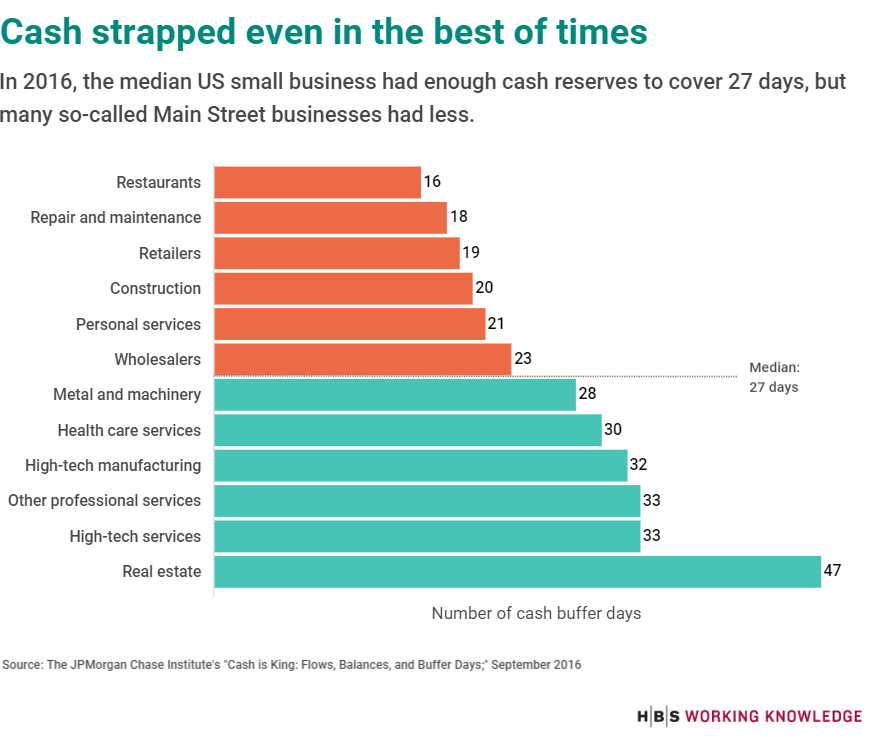

- Send tenants resources regarding small business loans and relief available in the New York City area and beyond. Facebook, for example, is offering $100 million in small business grants!

- Participate in open communication with tenants about what payments are feasible with their current situation.

- Offer to renegotiate terms of contracts, within reason.

- Collaborate with business owners about what services or revenue-generating operations they can still perform in the lockdown.

- Send tenants resources regarding small business loans and relief available in the New York City area and beyond. Facebook, for example, is offering $100 million in small business grants!

- Participate in open communication with tenants about what payments are feasible with their current situation.

It’s important to realize that tenants need to survive the length of the coronavirus pandemic, as well as stay open in the time that follows. As property owners and business tenants collaborate, the focus needs to be on long-term solutions.

Conclusions

The New York City real estate market is in an incredibly delicate position. The economic slowdown is affecting everyone and causing homeowners, landlords, businesses and tenants to struggle. There are, however, some bright spots of life in the market. This is, after all, New York City — surviving and thriving is in the city’s DNA!